401k 2025 Contribution Limit Over 50. The overall 401(k) limits for. This amount is up modestly from 2025, when the individual.

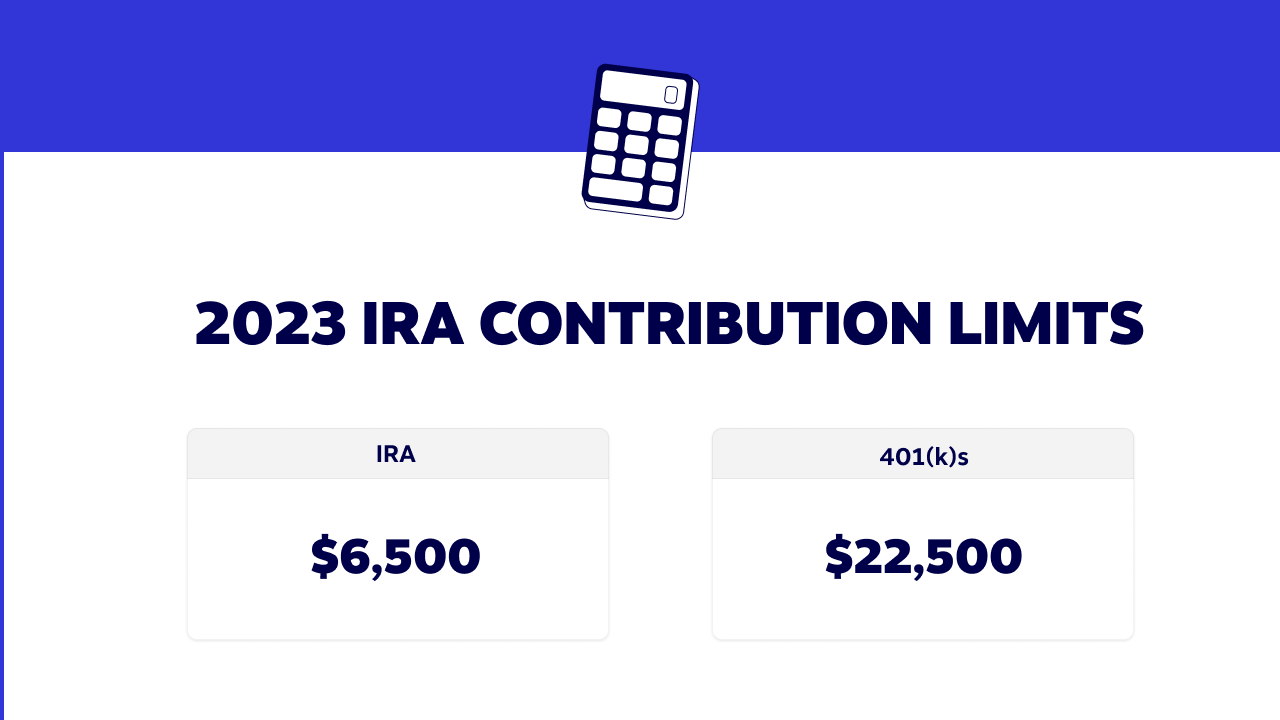

401k limit 2025 over 50. The 2025 contribution limit for 401 (k) plans is $23,000, up from $22,500 in 2025.

Of note, the 2025 pretax limit that applies to elective deferrals to irc section 401(k), 403(b) and 457(b) plans increased from $22,500 to $23,000.

Irs 401k Limits 2025 Over 50 Kelli Madlen, What is the 401k 2025 limit for over 50 barrie leonelle, for 2025, the limit for 401 (k) plan contributions is $23,000, up from $22,500 last year, according. Workers who contribute to a 401(k), 403(b), most 457 plans and the federal government's thrift savings plan can contribute up to $23,000 in 2025, a $500 increase.

401k Contribution Limits For 2025 Over 50 Gisele Gabriela, The total maximum allowable contribution to a defined contribution plan (including both employee. 401k limits for 2025 over age 50022 over 55 sonia eleonora, in 2025, the contribution limit for a roth 401(k) is $23,000, plus an additional contribution of $7,500 if you are age.

401k Contribution Limits for 2025 for Those Over 50 PD, Of note, the 2025 pretax limit that applies to elective deferrals to irc section 401(k), 403(b) and 457(b) plans increased from $22,500 to $23,000. For 2025, the 401 (k) contribution limit for employees is $23,000, or $30,500 if you are age 50 or older.

matching example_ Boeing.png?width=3720&name=401(k) matching example_ Boeing.png)

401k 2025 Contribution Limit Employer Match Maxie Sibelle, Here's how the 401 (k) plan limits will change in 2025: The 2025 contribution limit for 401(k) plans is $23,000, up from $22,500 in 2025.

401k Roth Contribution Limits 2025 Darb Minnie, Those 50 and older can contribute an additional. The 2025 contribution limit for 401(k) plans is $23,000, up from $22,500 in 2025.

401K Contribution Limits 2025 All You Need To Know About, 50 OFF, The 2025 catch‑up contribution limit for individuals aged 50 and over will stay at $1,000, the same rate from 2025. The 401 (k) contribution limit is $23,000.

401k Contribution Limits 2025 Get New Year 2025 Update, The 401 (k) contribution limit for 2025 is $23,000. The ira catch‑up contribution limit for individuals aged 50.

401k Employer Contribution Deadline 2025 Lotta Diannne, Employees age 50 and older can also direct an additional $7,500. As of 2025, individual employees have a 401 (k) contribution limit of $22,500, allowing them to contribute this.

What Is The 401k 2025 Limit For Over 50 Ynez Analise, Altogether, the most that can be contributed to your 401 (k) plan between both you and your employer is $69,000 in 2025, up from $66,000 in 2025. What is the 401k 2025 limit for over 50 barrie leonelle, for 2025, the limit for 401 (k) plan contributions is $23,000, up from $22,500 last year, according.

401k Limit 2025 Over 55 June Christiana, For 2025, the 401 (k) contribution limit for employees is $23,000, or $30,500 if you are age 50 or older. Key takeaways the irs sets the maximum that you and your employer can contribute to your 401(k) each year.

The 2025 catch‑up contribution limit for individuals aged 50 and over will stay at $1,000, the same rate from 2025.

DIY Tutorials WordPress Theme By WP Elemento